Supporting rural financial institutions through low cost, high impact digital solutions

Supporting rural financial institutions through low cost, high impact digital solutions

LendXS offers a digital SaaS services platform that supports financial institutions and agribusinesses with low-cost, high-impact process, payment and risk solutions. The LendXS tools include easy-to-use digital data collection, workflow management, credit scoring, payment support and performance management tools. These enable our clients to improve client onboarding and to scale their businesses at lower cost and risk. LendXS can be seamlessly integrated with the IT systems of our clients through tailored APIs.

The LendXS platform provides a full set of modular, low-cost digital tools that can be tailored to the unique needs of financial institutions and agribusinesses. Our services include digital loan origination, workflow management, data collection, credit scoring, payment support and impact assessment through customized dashboards. The modular set-up of our platform allows our clients to integrate the LendXS solutions seamlessly with their existing systems, enhancing operational efficiency and improving productivity, risk control and client engagement.

We conduct diagnostic assessments of the key operational and risk challenges and identify measures to reduce operational cost, improve risk management and to accelerate new loan origination.

Our low-cost SaaS solutions includes digital data collection, workflow management, credit scoring, loan portfolio monitoring and payment services support. Impact is measured through real-time, customized dashboards.

Besides offering technical support we offer our clients training and support to improve the operational performance of their organizations and to maximize impact.

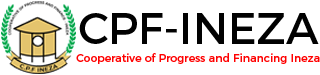

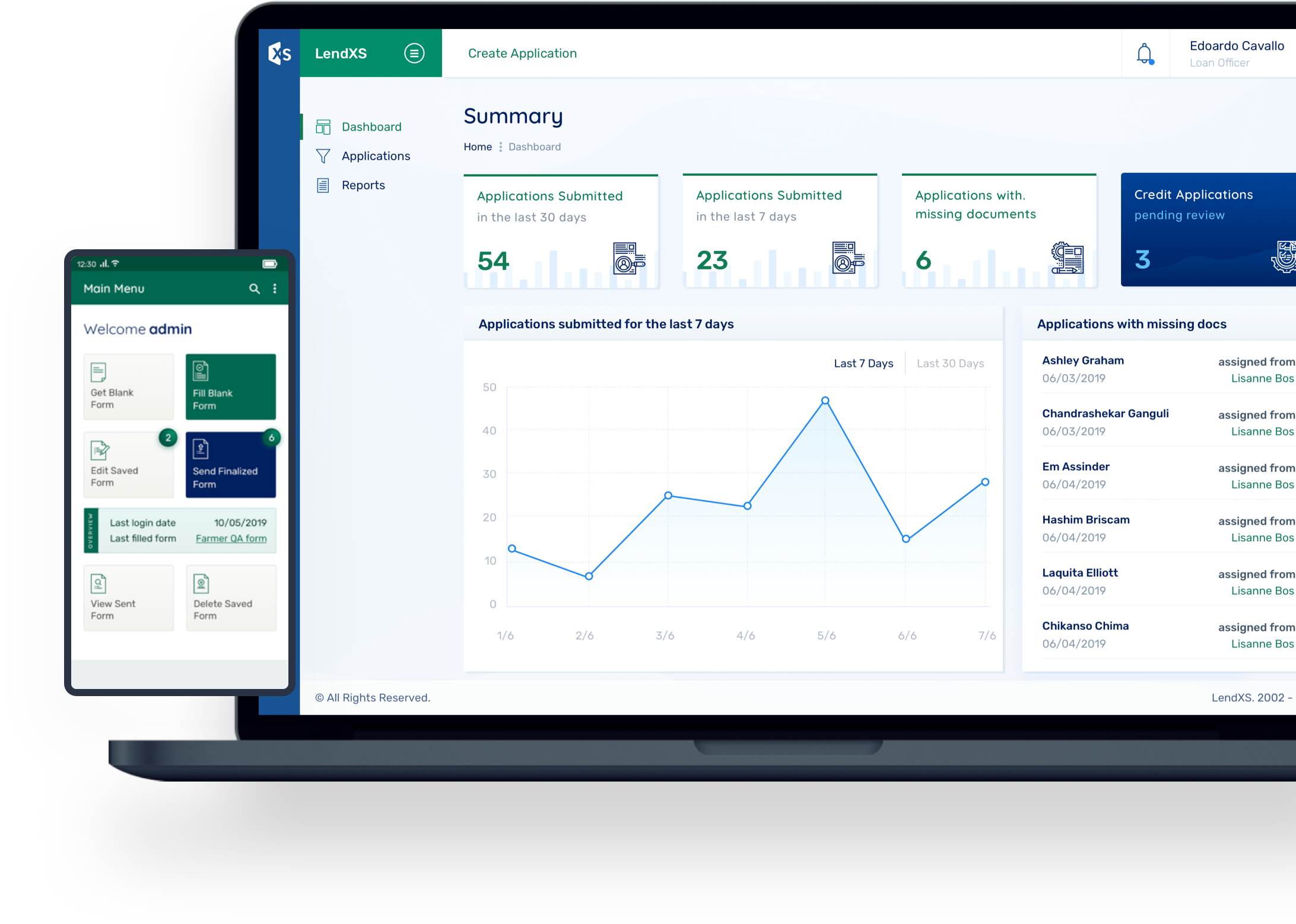

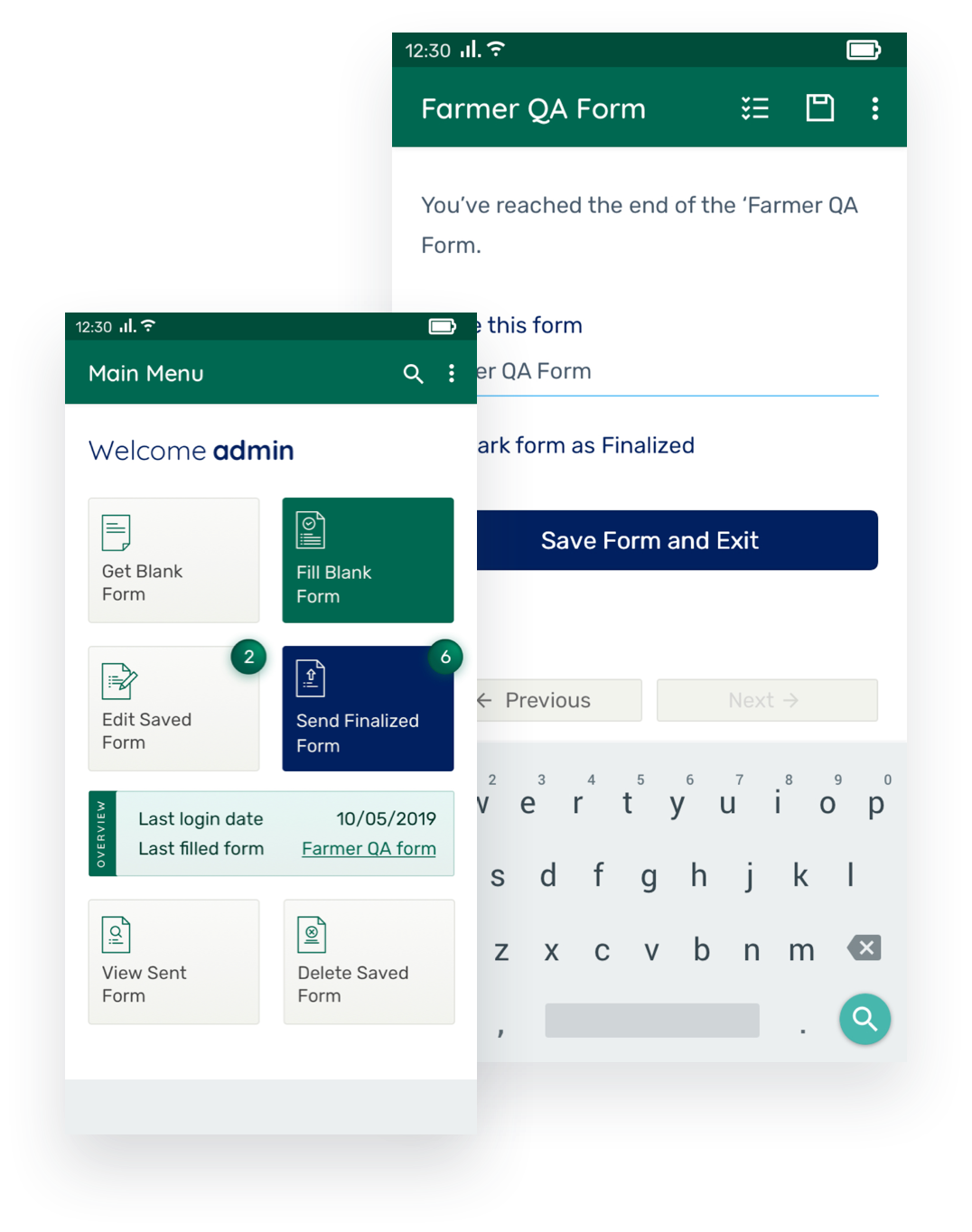

Digital data field application, which can be fully tailored to the KYC and other data requirements of our clients and reduces paper-based processes. LendXS Collect offers online and offline data collection, GPS location tracking, picture-taking and built-in data validation functionalities for better decision-making at lower cost.

Digital workflow management tool tailored to match the specific credit process requirements of our clients, including user roles and loan authorization limits.

Our web dashboard helps streamline loan approvals, track key performance indicators and visualizes them through interactive reports.

Digital credit scoring tool that analyzes the cashflows and determines the repayment capacity of loan applicants. It allows lenders to make informed loan decisions and build more resilient rural loan portfolios

Climate risk assessment module that allows lenders to quantify the impact of climate and weather risk on farm production and farmer income. It also identifies the interventions and investments required to adapt.

Customized web dashboards which helps to streamline loan approvals, track key performance indicators and to monitor efficiency improvements and impact metrics through interactive reports.

Interactive loan management tool that supports lenders to monitor loan repayment, timely identify potential loan defaults and to improve loan recovery management.

Low-cost payment module for agri businesses that facilitates immediate digital payment to the farmers’ bank accounts or mobile wallets upon delivery of their produce. This eliminates the use of cash, reduces cost and results in stronger, more stable supply chain relationships.

“Our Loan officers find the LendXS digital tools very user friendly and our experience is very positive. Our branch managers find it easier now to make loan decisions“.

Esther Moyi

Chief Executive Officer

ECLOF Kenya

“The LendXS solution offers seamless navigation and efficiency through digital forms and the promotion of data integrity and accountability. We recommend LendXS for their innovations that are cost-effective and with positive impact on our business“.

Evans Nakhokho

Chief Manager Agribusiness

Centenary Bank

“LendXS has consistently demonstrated a commitment to innovations and excellence. Their digital solutions have not only streamlined our processes, but have also played a pivotal role in accelerating rural financial inclusion, aligning with our mission at Ugacof. The user-friendly interfaces and robust functionalities of LendXS’s platform have significantly contributed to the efficiency of our operations. Moreover, their dedicated support team has been responsive and proactive in addressing our needs“.

Joe Hage-Chahine

Managing Director

Ugacof Ltd

At LendXS, we endorse the core principles of Client Protection Principles. These principles are the minimum standards that clients should expect to receive when doing business with a financial service provider, namely, appropriate product design and delivery, prevention of over-indebtedness, transparency, responsible pricing, fair and respectful treatment of clients, the privacy of client data, mechanisms for complaint resolution, prevention of over-indebtedness. We commit to the Client Protection Principles in the way we operate and relate to our own clients. LendXS digital solutions also play an important role in helping our financial institution clients build the capacity to implement these principles and realize their full potential.

Are you interested to see how LendXS can help your organization?

Fill out the form below and one of our team members will contact you with more information.